are electric cars tax deductible uk

Other benefits to leasing include not having to worry about depreciation fixed. This charge is deductible for corporation tax.

Tesla Asks Employees For Help Delivering 30000 Cars By End Of Quarter Tesla Tesla Model New Tesla

Businesses can benefit from the new super-deduction which offers 130 first-year allowance on qualifying electric charging points for cars and vans.

. But in 202122 electric cars are subject to just 1 in tax and in 202223 this will only rise by another. After five years the premium supplement is no longer paid. As corporation tax is 19 then your tax savings are calculated as 19 x 6000 1140.

Heres the latest iteration of the terms of the bill. So if you plan to purchase a company car it really is a no brainer to look at all electric options. You can also check if your employee is eligible for tax relief.

The relevant BIK percentage is applied to the list price of the car which must include the cost of the battery even when this is leased separately by the business. Federal tax credit for EVs will remain at 7500. Which is why EVs can drastically cut your company car tax bill.

Therefore it could be argued that 121 of the 5p is VAT. 24100 Van benefit-in-kind tax charge. There have also been reductions for electric hybrids depending on.

In our example the 35000 car would attract an immediate tax deduction of 6650. As such company car drivers can save thousands of pounds a year simply by switching from a diesel model to an EV. If the car is leased solely for business purposes then VAT is fully deductible however if there is any personal use then only 50 VAT is deductible.

However from April 2021 the Government will apply a nil rate for tax to zero. Annual BIK tax payments are a percentage of that taxable value and depend on your income tax rate. 655 The tax charge for zero-emission vans increases in 2020-2021 to 80 from 60 of the main rate.

This applies to all hybrid cars but not to fully electric cars. The employer will have a Class 1A NIC charge on the BIK currently at the rate of 138 increasing to 1505 from 6 April 2022. We Test Harder So You Can Choose Smarter.

As a higher rate taxpayer you buy a 50k VAT car through your business and you will be using it 5050 for business and personal use. Find out whether you or your employee need to pay tax or National Insurance for charging an electric car. You deduct the cost against profits.

Corporation tax deduction 19. In 20222023 the BiK tax band for fully electric vehicles is 2. 2 days agoElectric cars are pretty expensive though some of the cost can be offset by the 7500 federal tax credit.

There has always been a similar argument brought in an action by the European Court. Ad Get A Digital Membership For As Little As 5 For Your First Month 999 Thereafter. BiK bands range from 0-37 with higher-polluting models often sitting in the top band - meaning youll pay a lot more tax if you want a powerful petrol or diesel car.

Unfortunately the credit did have its. However HMRC maintains that the supply of domestic power is to the individual and VAT is not deductible by the business. If an electric car has CO2 with less than 50gkm of emissions can also qualify for 100 first-year capital allowances.

The UK Consumer Champion. The premium supplement for hybrid vehicles over 40k adds 335 to your annual road tax. Are electric cars tax-deductible in the UK.

So if your hybrid car was over 40000 from new you will pay an additional fee for five years from year 2. Buying a car through your business example. If the driver charges the car at home there would have been a VAT charge of 5.

BMW 320d M Sport Auto. Meanwhile new zero emission vehicles qualify for tax relief at 100 giving rise to an immediate tax deduction. This is multiplied by the P11D value and the employee tax rate.

So tax relief for leasing an electric car is given each year depending on the cost and business use contrasted with outright purchase which provides an initial and one-off tax deduction. Financial Year 202122 sees pure-electric models rated at 1 for BIK and these rates only climb to 2 for FY 2223 and 2324. Car fuel benefit charge.

Tax credit cap for automakers after they. From April 2020 the tax charge for electric-only cars fell to 0 but for 202122 it increased to 1 and then further increases to 2 for 202223. This electric car tax relief is potentially a big saving for employees making them more likely to choose an electric vehicle as a company car.

Heres an example of the tax savings you can make by leasing. 3430 Van fuel benefit charge. From 6 April 2020 businesses can claim 100 of the cost of an electric vehicle against the profits of the year of purchase and there are no restrictions on the value of the vehicle.

BiK tax rates on electric cars are calculated based on the list price or P11D value of the car including VAT and delivery charges the cars CO2 emissions and the employees income tax band. Use the company car tax calculator to calculate the company car tax due for any electric vehicle or. You lease an electric car for 6000 over the 2022-23 financial year.

There are three bands. For the 2019-20 tax year low emission cars classed as up to 50gkm were taxed at 16 of the list price or 20 for diesel cars.

Should I Buy Electric Cars Or Hybrid Now Automotive News

Charging Of Electric Vehicles Should It Be Exempt Or Attract 18 Gst The Financial Express

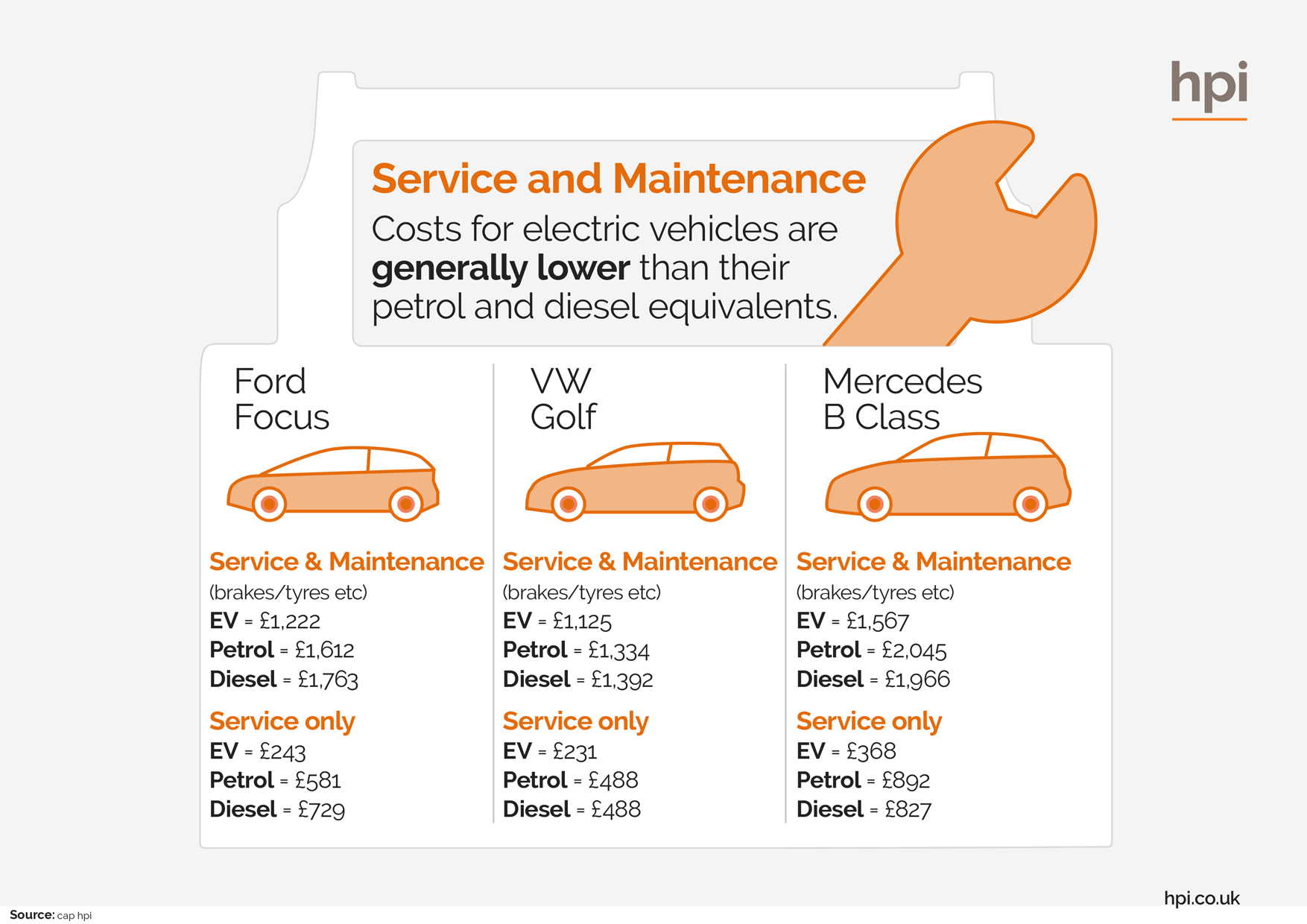

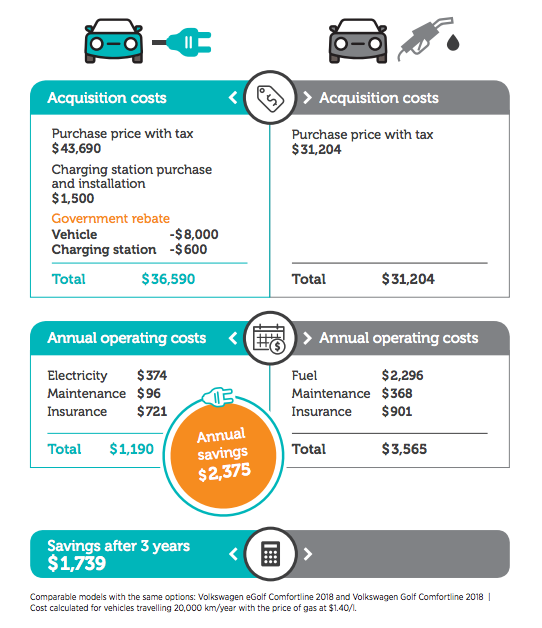

Ev Car Maintenance Cost Off 71

Audi Reduces Planned E Tron Electric Suv Production Due To Battery Shortage Report Says Read More Technology News Here Https Electric Cars Electricity Audi

Ev Car Maintenance Cost Off 71

Ev Car Maintenance Cost Off 71

Should I Buy Electric Cars Or Hybrid Now Automotive News

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption International Council On Clean Transportation

Investor S Guide To Electric Vehicle Etfs Bankrate

Electric Car Tax Credits What S Available Energysage

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption International Council On Clean Transportation

Ev Car Maintenance Cost Off 71

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption International Council On Clean Transportation

Video Affiliation Grant Cardonne Tay Lopez Dropshipping Email Marketing Entrepreneur Usa United States Us Uk Finance Investing Budgeting Money Investing Money

Should I Buy Electric Cars Or Hybrid Now Automotive News

Should I Buy Electric Cars Or Hybrid Now Automotive News

Electric Car Demand Behind 8 000 Jump In Net Cash Flow For Byd Bloomberg

Hiriko The Fold Up Electric Two Seater Electric Cars Electric Car Electricity