Fed rate hike

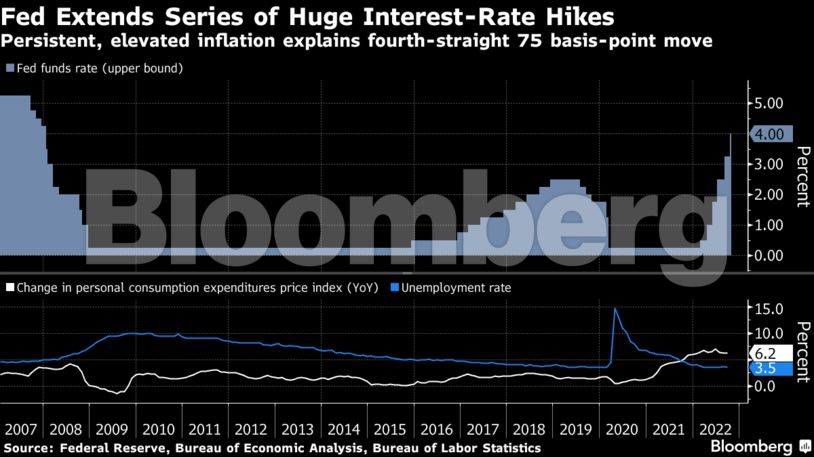

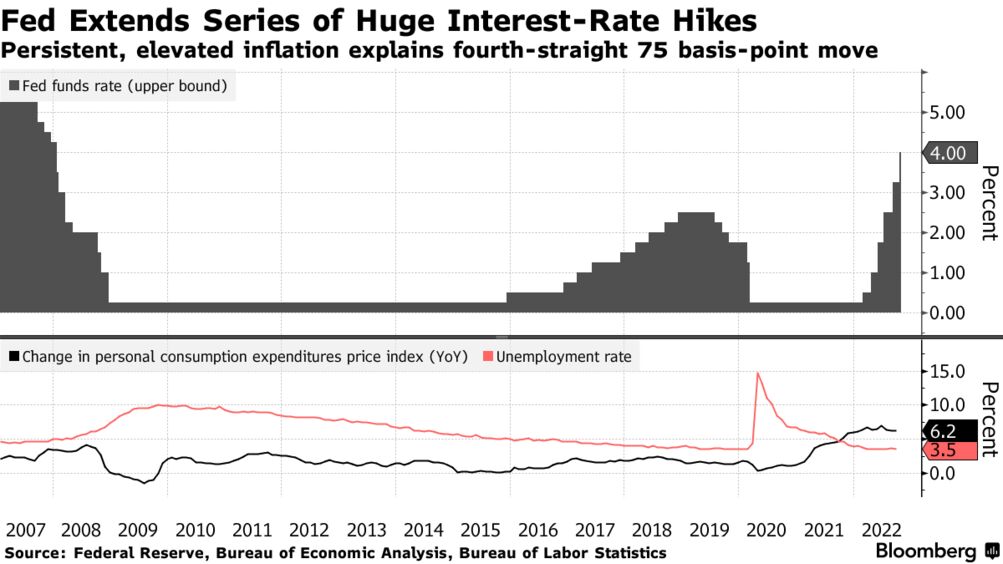

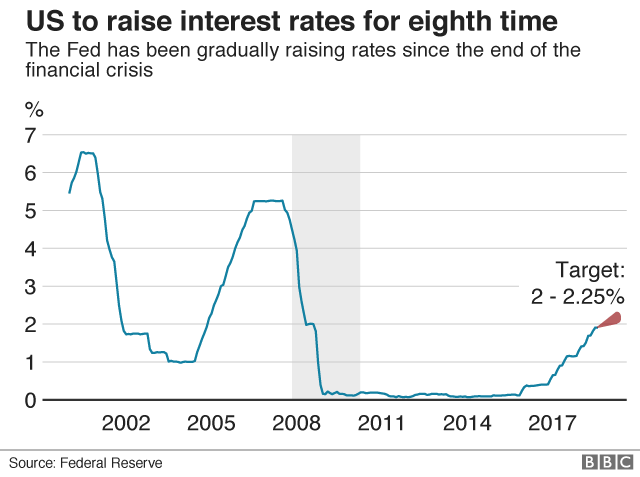

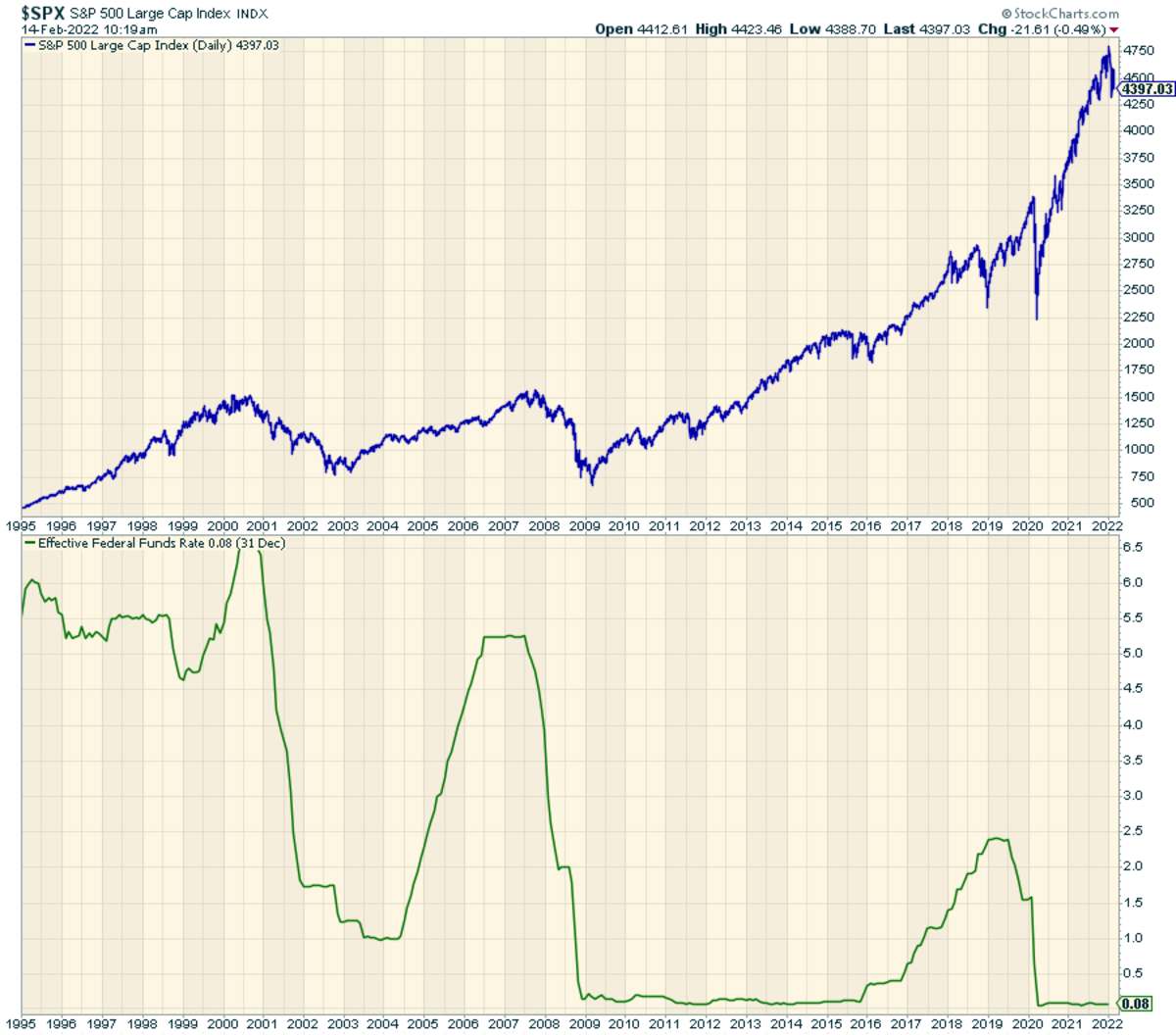

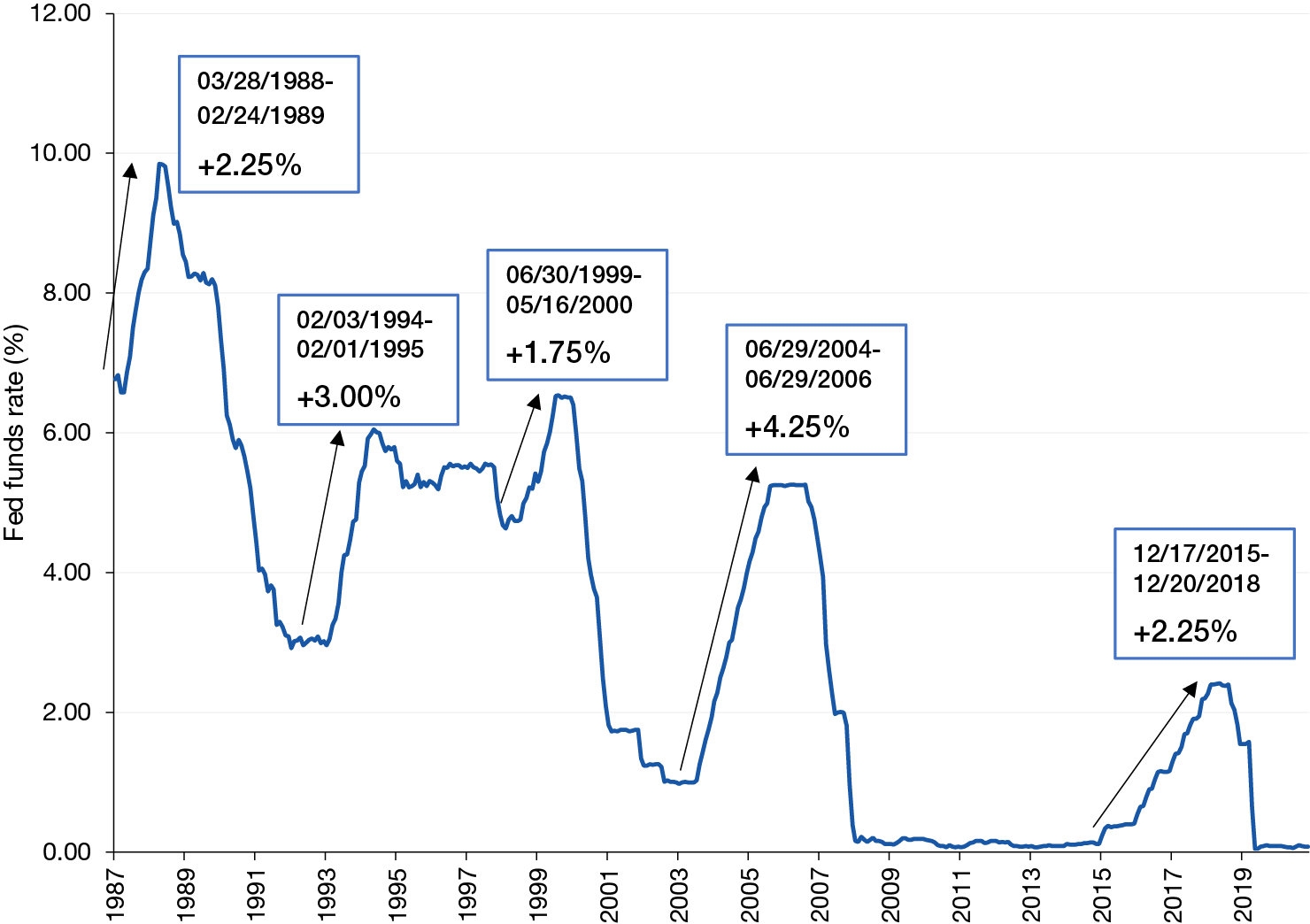

The rate hike is the sixth consecutive one this year for the Fed a cycle not seen since the inflation-fighting days of the early 1980s. The series of big rate hikes are expected to slow down the economy.

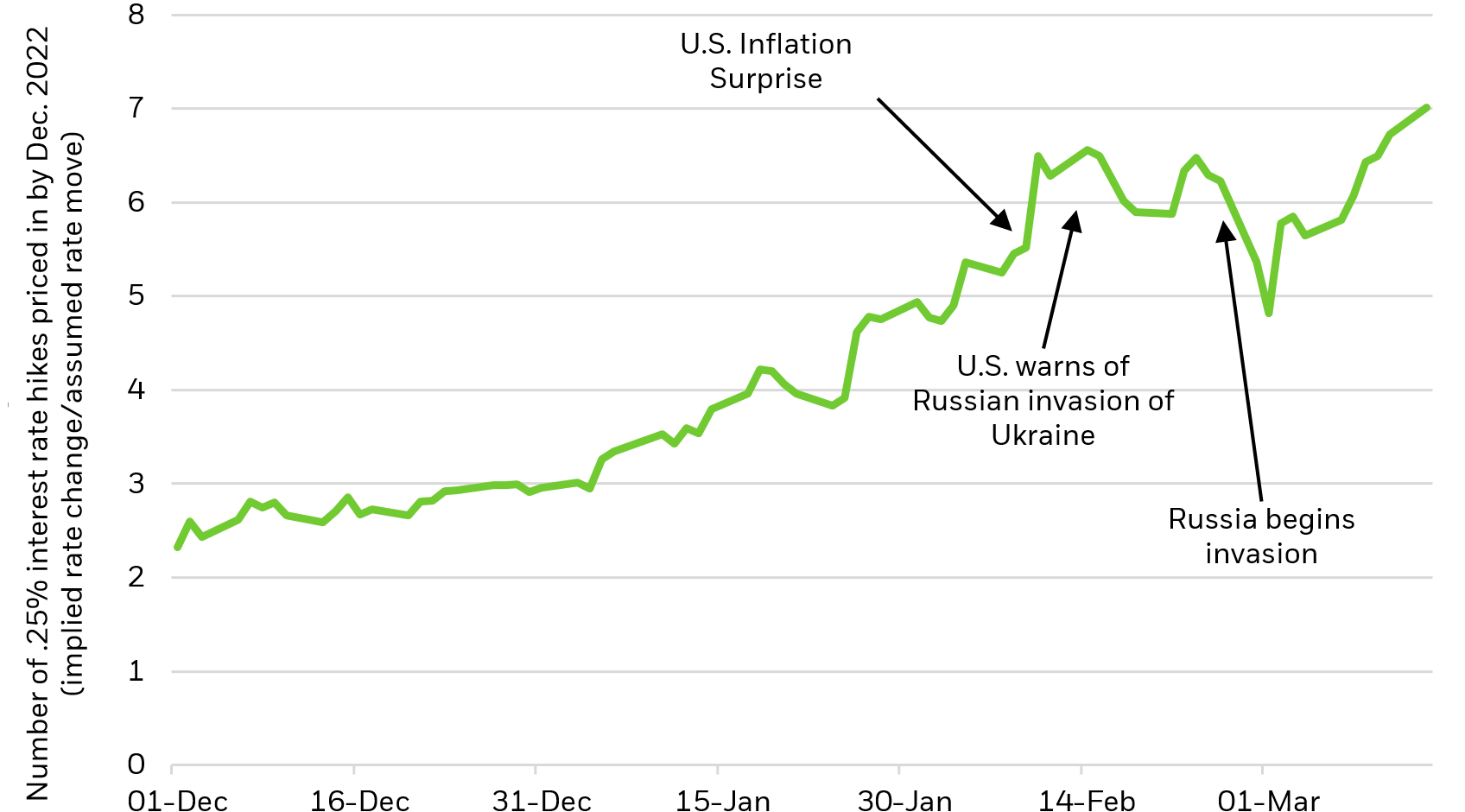

Market Expectations Grow For Early Fed Rate Hike As Inflation Rises S P Global Market Intelligence

The benchmark rate stood at 3-325 after.

. 21 hours agoFred Imbert The Federal Reserve delivered its latest monetary policy announcement with the central bank hiking rates by 75 basis points or 075 percentage point. Its easy to forget that the Fed was holding the federal funds rate at around zero as recently as the first quarter of 2022. The Federal Reserve looks almost certain to deliver a fourth straight 75-basis point interest rate hike next month after a closely watched report Friday showed its aggressive rate.

What rate hikes cost you. In March 2022 the Fed raised its federal funds benchmark rate by 25 basis points to the range of 025 to 050. Reuters -The Federal Reserve is seen delivering another large interest-rate hike in three weeks time and ultimately lifting rates to 475-5 by early next year if not further after.

1 day agoFed latest rate hike. The Fed is expected on November 1-2 to deliver its fourth straight rate hike of 75 basis points and its sixth increase of 2022. Every 025 percentage-point increase in the Feds benchmark interest rate translates to an extra 25 a year in interest on 10000 in debt.

21 hours agoThe latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008. 18 hours agoThe Federal Reserve raised interest rates 75 basis points on Wednesday bringing its federal funds rate target to a range of 375 to 4. A hike in the Fed Funds rate is one of the key monetary policy levers that the Central Bank has in its arsenal to slow down inflation by making it more expensive to borrow.

The latest increase moved the. The central bank has been bedeviled by. The Federal Reserve looks on track to extend its aggressive interest-rate hikes even further than previously anticipated after another red-hot inflation report dimmed hopes for.

Thats considered restrictive territory where. The Fed looks at a number of different inflation barometers and none of them is. 1 day agoThe better known consumer price index shows prices rising even faster at an annual rate of 82.

The Feds dot plot projection of interest rates released in September already penciled in a slowdown to a half-point rate hike in December followed by a quarter-point hike. 20 hours agoWith rates well over the 2 inflation goal the Fed reacted by raising rates a quarter percentage point in March a half point in May and three quarter points in June July and. The Fed emphasized its awareness of.

075 to 100. 1 day agoWASHINGTON Nov 2 Reuters - The Federal Reserve raised interest rates by three-quarters of a percentage point again on Wednesday and said its battle against inflation will. The rate hike marked the first time since 2018 that the Fed has.

How will it affect mortgages credit cards and auto loans The Fed as widely expected raised its key short-term rate by three-quarters of a percentage point to a. The rate-making Federal Open Market Committee hiked the benchmark interest rate by 075 percentage points at the end of a two-day meeting. 1 day agoWednesdays expected hike would bring the Feds policy rate known as the federal funds rate to between 375 and 4 percent.

During his post-meeting conference Fed Chair Jerome Powell. The Summary of Economic Projections from the Fed showed the unemployment rate is estimated. Along with the massive rate increases Fed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023.

Maneuvering Through The Fed S Hiking Cycle Ishares Blackrock

Stocks Fell Right After Fed Raised Interest Rates Will This Continue

The Fed Hikes Up Interest Rates In An Effort To Curb Inflation Wzzm13 Com

How The Fed S September Interest Rate Hike Will Affect You Money

5 Things To Know About The Fed S Biggest Interest Rate Increase Since 1994 And How It Will Affect You

Goldman Says Market Overpricing Odds Of Fed Rate Hike In Relief For Bitcoin Bulls Coindesk

The Latest Fed Rate Hike Is The Largest In 28 Years Here S The Silver Lining For Savers Nextadvisor With Time

Federal Reserve Raises Interest Rates Again Bbc News

The Last 3 Rate Hike Cycles Ended Badly This One Probably Will Too Etf Focus On Thestreet Etf Research And Trade Ideas

Treasury Two Year Yields Head For 4 Ahead Of Big Fed Rate Hike

Fed Barrels Toward Another 75 Basis Point Rate Hike As High Inflation Persists Fox Business

Global Interest Rates Are On The Rise Lpl Financial Research

Which Assets Have Done Well During Fed Rate Hikes

Fed Boosts Rates For First Time In 4 Years

How High Can The Fed Hike Interest Rates Before A Recession Hits This Chart Suggests A Low Threshold Marketwatch